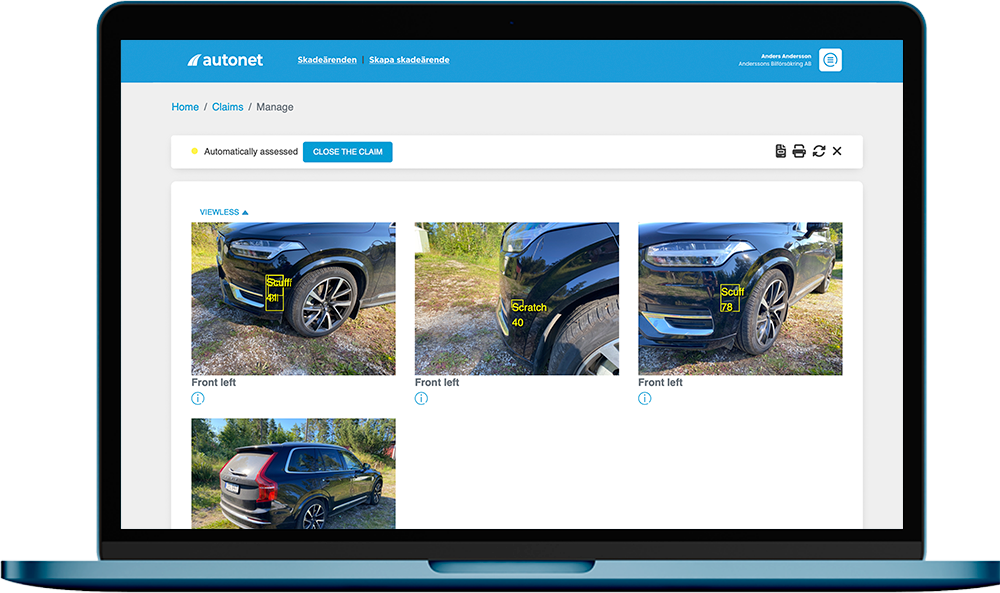

The World’s Leading AI Tool for Handling Claims

Let AI and image recognition do the heavy lifting, while you focus on your customers.

Who is Autonet?

We offer a software service designed to streamline and automate the claims handling process for insurance companies and fleet operators. Our market-leading image recognition and AI-powered decision engine optimizes the claims process for vehicle damages. Our solutions help you close cases faster and at a lower cost – all while contributing to a more sustainable world!

Picture this: Snap 7 photos and get assistance in under 15 minutes.

Autonet is designed to help insurance companies get their customers back on the road faster, while also reducing their environmental footprint and contributing to a more sustainable world. By conducting a photo inspection of the car’s damage, unnecessary trips to and from the workshop are avoided, saving valuable time for the customer and reducing emissions.

STEP 1

Capture

The Autonet application launches through an SMS link, QR code, or webpage – no download required! With guidance from our app, the customer takes photos of the damage and uploads them to Autonet.

STEP 2

Analyze

Through image recognition and AI, Autonet can estimate the damage and locate the workshop best suited to handle the case.

STEP 3

Allocate

Autonet automatically sends cases to the correct repair partners. The workshop accepts the claim request, and schedules the reparation together with the customer.

STEP 4

Verify

As soon as the car gets uploaded into the system, the insurance company receives an estimated cost for repair, which minimizes administrative lead time.

Repair routing and cost estimation

– what’s included?

AI Vehicle Triage

Predict vehicle total loss with high accuracy in less than 3 minutes.

Workshop routing

Model decisions and sensitivity calibrated to your criteria.

Precise calculations

Instantly identify the severity of vehicle damage and map out the affected parts.

Guided mobile app

Easy-to-use mobile app that guides the policyholder to capture photos of the vehicle. No download required!

API Support

Comprehensive APIs for custom integration into client systems.

White label solution

The app can be adjusted according to your business and brand identity.

Key benefits in real time numbers

Reduced lead time

~50%

Autonet’s extensive data helps everyone involved in the insurance process to review and approve the figures for the claim, cutting administrative lead time by up to 50%.

Uploaded images

~140k

Based on over hundred thousands of images from real life accidents, we custom the decision logic to your preference. Together we analyze how cases should have been handled and incorporate the findings into the decision logic.

Saved emissions

~40 ton

In 2024, we reduced CO2 emissions 40 ton by eliminating unnecessary trips to workshops. Our efficient solutions both save time and contribute to a greener, more sustainable future.

Case study

AI based on real-life cases

Thanks to its generative AI capabilities, our services constantly learn from both past and present cases, resulting in increasing accuracy and efficiency as it processes more claims. This enables insurance companies to provide faster customer service with fewer errors, making our solution market-leading and optimized for your business.

Currently, our data is derived from over 140,000 images of real-life damages and accidents. With new cases being uploaded daily, our AI engine’s decision logic will continue to improve.

Our products

AI Repair

Easier claims processing powered by AI

Estimate and Calculation Verification

Get closer to hitting the bullseye

Review

Be one step ahead

Let’s talk!

Ready for smarter claims handling?

We’re looking forward to hearing from you!

Don’t hesitate to reach out – we’ll get back to you as soon as possible.

News

-

Press release: Insurance industry utilizes AI for faster claims handling

Read more: Press release: Insurance industry utilizes AI for faster claims handling -

LF Västernorrland implements AI for vehicle damages

Read more: LF Västernorrland implements AI for vehicle damages -

Join us at Messekongress Schadenmanagement & Assistance

Read more: Join us at Messekongress Schadenmanagement & Assistance

Our partners